Learning from last Week: (click here for the previous post)

Patterns:

Bears close the index below the Day fork, Bulls manage to close above 2116 #Daychart1, Last week however engulfs the previous week #Weekchart1.

Support & Resistance:

Resistance was at the daily 50MA #DayChart1. Support near the our mark 2116 #Daychart1.

Moving Averages:

The critical EMA 5, is bullishly above the MA13, only on the Month Chart #Monthchart1.

Indicators:

The RSI heads towards the over sold #WeekChart2.

Wrap:

Bears hold the Index below the bottom Tyne of the Day Fork #DayChart1 and make a weekly Engulfing pattern #WeekChart1.

Looking forward into this Week:

Patterns:

'Evening Star' Pattern (Study Links here, here or elsewhere) is active on the Long term charts #MonthChart1.

'Engulfing Pattern' is active on the Weekly Charts (Study Links here, here or elsewhere).

Support & Resistance:

2116 is the support that Bears would want to close the week below. Daily 50MA is resistance #DayChart1.

Moving Averages:

5 EMA on the Week chart i,e, 2140, is the mark, that the Bulls want to stay above, this week #WeekChart1.

Indicators:

TSI returns from resistance at the 74% Fibonacci mark #MonthChart2.

Wrap:

Bulls after defending 2116, look to close above 2140.

Bears need to close well below 2116 and make a lower low #DayChart1.

Introduction / Primer to Ichimoku can be read at this link (click).

Learning from the Earlier Study: (click here for the previous post)

Index moves down after facing resistances seen in previous weeks - Tenkan Sen provides exact support #W2.

Chikou Span turns down facing resistance at the Kumo bottom #W1.

Bears defend the recent highs #W2.

Wrap:

Index is stopped by the Chikou Span resistance at the Kumo #W1. Tenkan Sen gives precise support #W1.

Looking Forward into this Week:

Bulls look to make this fall a higher low, so as to maintain the current trend #W2.

Bears want the index below the Tenkan Sen and back in the Kumo #W2.

Kijun Sen (inside the Kumo) is last line of defense for Bulls W2.

Wrap:

Bears look to use fall to get below the Kijun Sen #W2.

Bulls look to make a higher low and keep the up move intact #W2.

Learning from last Week: (click here for the previous post)

Patterns:

Index manages to get back into the Day Fork after falling off #Daychart1, making an inside week in the process #Weekchart1, and closing above our mark 2141.

Support & Resistance:

Resistance was again at the daily 13MA #DayChart1. Support near the bottom Tyne of the Day Fork #Daychart1.

Moving Averages:

The critical EMA 5, is bullishly above the MA 13, only on the Month Chart (landing 1909 for Oct'16) #Monthchart1.

Indicators:

The RSI is near the center of the range #WeekChart2.

Wrap:

Bulls hold the Action above the bottom Tyne of the Day Fork #DayChart and make a green week.

Looking forward into this Week:

Patterns:

'Evening Star' Pattern (Study Links here, here or elsewhere) is active on the Long term charts #MonthChart1.

Support & Resistance:

Bottom Tyne of the Day Fork is support #DayChart1. Middle Tyne of the Fork on the Week chart is resistance #WeekChart1.

Moving Averages:

5 EMA on the Month chart i,e, 2141, is the mark, that the Bulls want to stay above, this month #MonthChart1.

Indicators:

TSI returns from resistance at the 74% Fibonacci mark #MonthChart2.

Wrap:

Bulls after allowing an Evening Star #MonthChart1, get a save, closing above 2141.

Bears want to keep below the middle Tyne of the Week Fork, and aim for life below 2116.

Learning from last Week: (click here for the previous post)

Patterns:

Index closes the week above the neckline of a 'Head and Shoulder' Pattern #DaiyChart1 Link (Click)

Support & Resistance:

New Day Fork's middle Tyne and 50MA were resistances #DayChart1

Index gets support at the H&S neckline and Day Fork's bottom Tyne #DayChart1.

Moving Averages:

The critical EMA 5, is bearishly below the MA 13 only on the weekly screen #WeekChart1.

Indicators:

The STC stays, well above the 76% Fibonacci retrace #MonthChart2.

Wrap:

Bears defend the Daily 50MA, Bulls keep above the neckline of the H&S pattern #DayChart1.

Looking forward into this Week:

Patterns:

Head & Shoulder pattern is active on the Day chart (Study links here, here or elsewhere) Bears pray the Index crashes below the Day Fork #DayChart1.

Support & Resistance:

Middle Tyne of the Fork on the Day chart is the first resistance #DayChart1. Neckline of the Head & Shoulder Pattern or Day Fork's Bottom Tyne are the first Supports (Link).

Moving Averages:

The 50 & 200 MA, are a in a 'Golden Cross' on the Day Screen #DayChart1.

Indicators:

The MACD is above its MA and its histogram is above zero #DayChart2.

Wrap:

Bears look to break below the H&S neckline, while keeping below the Daily 50MA #DayChart1.

Bulls want to break the current down trend, by closing above 8808 #DayChart1.

Introduction / Primer to Ichimoku can be read at this link (click).

Learning from the Earlier Study: (click here for the previous post)

Index ranges within previous week's Open and Close making a Doji in the process #W2.

Chikou Span stuck at the Kumo bottom - which itself is moving up next week #W1,

Bears defend the recent highs #W2.

Wrap:

Index stays inside previous week's candle, Chikou Span again halts at the Kumo #W1.

Looking Forward into this Week:

Bulls now want Higher Highs and Higher Lows #W2.

Bears want the index below the Tenkan Sen #W2.

Chikou Span can now slide up along the Kumo bottom, where its stuck for some time W1.

Wrap:

Bears look to use current resistance to get some more red on the screen #W2.

Bulls look to get the Chikou Span into the Kumo or move up with it #W2.

Learning from last Week: (click here for the previous post)

Patterns:

After the 'Evening Star' pattern triggers on the long term screen #MonthChart1, Index continues to face resistances at the middle Tyne of the Week and Day forks.#WeekChart1, #Daychart1.

Support & Resistance:

Resistance was again at the middle Tyne of the Week Fork #WeekChart1. Support near the bottom Tyne of the Day Fork #Daychart1.

Moving Averages:

The critical EMA 5, is bullishly above the MA 13, only on the Month Chart (landing 1909) #Monthchart1.

Indicators:

The RSI is near the center of the range #WeekChart2.

Wrap:

Bulls hold the Action above the bottom Tyne of the Day Fork #DayChart. Bears move index down and get another red weekly candle #WeekChart1.

Looking forward into this Week:

Patterns:

'Evening Star' Pattern (Study Links here, here or elsewhere) is active on the Long term charts #MonthChart1.

Support & Resistance:

34 MVWAP on the Week chart is support. Middle Tyne of the Fork on the Week chart is resistance #WeekChart1.

Moving Averages:

5 EMA on the Month chart i,e, 2141, is the resistance, that the Bulls want to be above, this month #MonthChart1.

Indicators:

TSI returns from resistance at the 74% Fibonacci mark #MonthChart2.

Wrap:

Bulls after allowing an Evening Star #MonthChart1, need a save, getting above 2141.

Bears want to keep below the middle Tyne of the Week Fork and aim for life below the MVWAP 34 #WeekChart1.

Learning from last Week: (click here for the previous post)

Patterns:

Index closes the week on the neckline of a 'Head and Shoulder' Pattern #DaiyChart1 Link(Click)

Support & Resistance:

Day Fork's middle Tyne and 13MA were resistances #DayChart1

Index closes below the 50 MA and Day Fork's bottom Tyne #DayChart1.

Moving Averages:

The critical EMA 5, bearishly below the MA 13 on all except month screen #MonthChart1.

Indicators:

The STC stays, well above the 76% Fibonacci retrace #MonthChart2.

Wrap:

Bears close below the Day Fork, Bulls close above the neckline of the H&S pattern #DayChart1.

Looking forward into this Week:

Patterns:

Head & Shoulder pattern is active on the Day chart (Study links here, here or elsewhere) Bears need the Index crashing below the neckline #DayChart1.

Support & Resistance:

Bottom Tyne of the Fork on the Day chart is the first resistance #DayChart1. Neckline of the Head & Shoulder Pattern is the first Support (Link).

Moving Averages:

The 50 & 200 MA, are a in a 'Golden Cross' on the Day Screen #DayChart1.

Indicators:

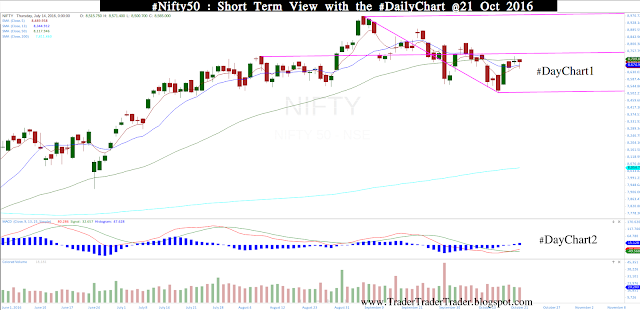

The MACD and its histogram, are below zero #DayChart2.

Wrap:

Bears look to break the H&S neckline and get below last week's low 8541 #DayChart1.

Bulls want to break the current down trend, by getting above 8808 #DayChart1.

Introduction / Primer to Ichimoku can be read at this link (click).

Learning from the Earlier Study: (click here for the previous post)

Index clears June high after popping above the Kumo #W2.

Chikou Span halts at the Price line, Tenkan Sen clears Kumo top #W1,

Bears give up the June high #W2.

Wrap:

Index clears June high, Chikou Span halts at the Kumo #W1.

Looking Forward into this Week:

Bulls now want Higher Highs and Higher Lows #W2.

Bears want the index below the Tenkan Sen #W2.

Chikou Span nudging the price line - bearish cross or bullish deflection, on next #W1.

Wrap:

Bears look to use current resistance to get some red on the screen #W2.

Bulls want to keep clear of the Kumo and get the Chikou Span into the Kumo #W2.

Learning from last Week: (click here for the previous post)

Patterns:

After the 'Evening Star' pattern triggers on the long term screen #MonthChart1, Index faces resistances at the Week and Day forks.#WeekChart1, #Daychart1.

Support & Resistance:

Resistance was again at the middle Tyne of the Week Fork #WeekChart1. Support near the 5 EMA on the Month chart #Monthchart1.

Moving Averages:

The critical EMA 5, is bullishly above the MA 13, only on the Month Chart #Monthchart1.

Indicators:

The RSI is near the oversold #WeekChart2.

Wrap:

After the Evening Star triggers on the Month Chart #MonthChart. Bears move index down and get a red weekly candle #WeekChart1.

Looking forward into this Week:

Patterns:

'Evening Star' Pattern (Study Links here, here or elsewhere) is active on the Long term charts #MonthChart1.

Support & Resistance:

5 EMA on the Month chart is support #MonthChart1. Middle Tyne of the Fork on the Week chart is resistance #WeekChart1.

Moving Averages:

5 EMA on the Month chart i,e, 2141, is the support Bulls want to defend #MonthChart1.

Indicators:

TSI returns from resistance at the 74% Fibonacci mark #MonthChart2.

Wrap:

Bulls after allowing an Evening Star #MonthChart1, need a comeback, staying above 2141.

Bears want to keep below the middle Tyne of the Week Fork #WeekChart1 and aim for life below 2141.