.....Regulars can skip below and go straight to the chart......

Quick Reference :

Chikou Span - pink line,

Kijun Sen - blue line,

Senkou Span A - black line,

Senkou Span B - grey line,

Kumo - grey shaded area,

Tenkan Sen - red line.

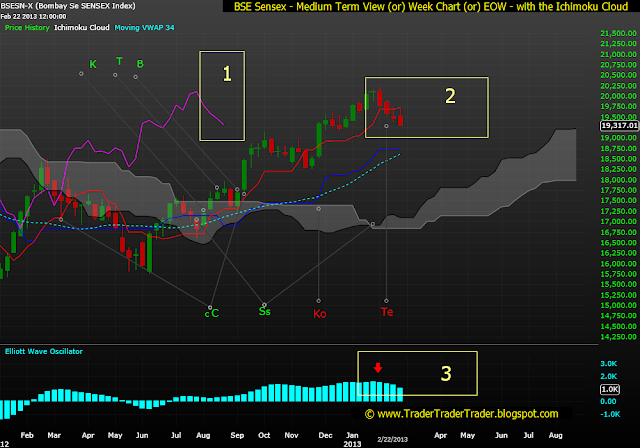

Previous Signals seen on BSE 30 - Week Chart (EOW) marked on chart as per notes below:

The Senoku Span Cross: Neutral Bullish Signal (Ss)

The Kijun Sen Cross: Neutral Bullish Signal (K)

The Tenkan Sen/Kijun Sen Cross: Strong Bullish Signal (T)

The Kumo Break-out: Bullish Signal (B)

The Chikou Span Cross: Strong Bullish Signal (Cc)

The Flat Kumo: Bearish Signal (Ko)

Last:

The Tenkan Sen Cross: Weak Bearish Signal (Te)

|

| BSE 30 - End of Week Chart (EOW) - Analyzing 12 months Data - as on 15 Feb'13 |

Learning from the Past Week: (click here for the post)

Bears keep the Index below the Tenkan Sen #2 - again.

Oscillator ticks down and Divergence to Price continues #3.

Chikou Span dives towards the Price line #1

Bears follow up the break of the Tenkan Sen last week, with another red candle, to retain the Medium term Screen.

Looking Forward into the next Week:

Staying above the blue Kijun Sen - Bulls still have an edge.

Bears see strength, staying below the Tenkan Sen #2.

Bulls need to re-conquer the Tenkan Sen to get back some Strength..