|

| Nifty 50 - End of Month (EOM) Chart - Channel analyzing Data from 2008 onward - as on 17 Jan'14 |

|

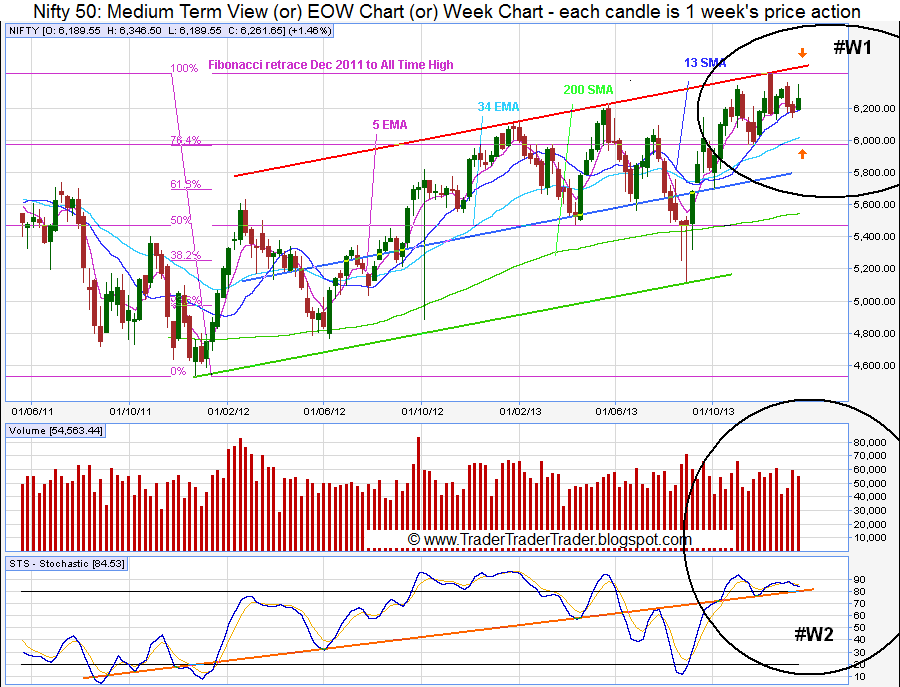

| Nifty 50 - End of Week (EOW) Chart - Channel analyzing Data from Mid 2011 onward - as on 17 Jan'14 |

|

| Nifty 50 - End of Day (EOD) Chart - Channel analyzing Data from Aug'2013, onward - as on 17 Jan'14 |

Learning from last Week: (click here for the previous post)

Patterns:

- November and December candles will set up a Long Term 'Three Outside up' if January closes above December Close #M1.

- The EOW #W1 shows a Medium Term 'Three Outside Down' Candle Pattern followed by last week's green candle.

- Index breaks last week's resistance 13 SMA (EOD) to pull off a 250 odd point move but closes just below the Monthly 'Pivot Point' (Learn here, here or elsewhere) #D1.

- Bears held at Channel mid line Support on the EOD above most of the MAs we track, while Bulls were resisted last week near the previous ATH 6343.

- EOD - 50 SMA and 200 SMA continue converging for a Death Cross even as they currently stay crossed bullishly in a Golden Cross #D1.

- The medium term 5 EMA kept above the 13 SMA by the Bull up-move #W1.

- STS stays above resistance line #W2, a strong support for Bulls.

- MACD moves back into the plus zone with a negative divergence (arrow) #D2.

Wrap:

Bulls regain control of all screens - Bears continue to keep index below the Wall (6280) #W1.

Looking Forward into this Week:

Patterns:

- Bullish 'Three Outside up' (Study link here, here or elsewhere) on the Long Term Chart #M1 is possible - to be watched for.

- Bearish 'Three Outside down' (Study link here, here or elsewhere) on the Medium Term Chart, #W1 is active.

- 13 SMA Weekly (6195), is now support for the Index #W1.

- Earlier ATH i.e. 6343 is the current resistance holding back Bulls.

- Golden Cross (study here, here or elsewhere) 50 & 200 SMA - can even now give the Bulls verve to attempt new ATHs.

- Getting above the 5 EMA on the EOD is the immediate Bull task #D1.

- STS keeping above its support line, works for the Bulls #W2.

- Bulls need to cross and sustain above the Wall for the current series i.e. 6280 (Wall = Approx Hawala rate - study link here, here or elsewhere) to get back into the game.

Wrap:

Bulls seek to get above the Wall and target the ATH - Bears plan to stay below the Wall and break 6195.